Most people have access to a few different types of Tax-Advantaged Retirement Accounts. We will get to the types of individual retirement accounts in a moment. First I want to explain the huge advantage of making investments with pretax dollars.

The main advantage of these types of accounts is twofold:

- The money invested are pretax dollars boosting your return right from the moment your invest.

- The money invested grows tax free until the time of distribution.

- The money invested each year can typically be deducted against your taxable income.

Let’s use an example with some basic calculations.

Scenario #1

- Annual Wages: $75,000.00

- Marginal Tax Rate: 25%

- Maximum Allowed Retirement Contribution: $18,000 in a 401(k) + $5,000 in a traditional IRA, or $23,500

This example is extreme but I just wanted to show the power of investing pretax dollars.

- Taxes without Retirement Contributions: $18,750

- Net Income after Taxes and Contributions: $56,250

- Taxes with Maximum Allowed Retirement Contributions: $12,975

- Net Income After Taxes and Contributions: $38,525

Now the numbers to pay attention to here the two Net Incomes in these scenarios. The difference between the two Net Incomes amounts to $17,725, less than the $23,500 contributed to the Tax-Advantaged Retirement Account. There are a number of ways to think about this.

The most basic way to this of this is that you contributed $17,725 into your retirement account and Uncle Sam through tax incentives bumped that initial investment up to $23,500. That is $5,775 of investment earnings on the first day. The immediate return based on that thinking is 32.58% return on your money on day 1.

We understand that most people are not in a financial situation that would allow them to put aside nearly a third of their disposable income. This scenario illustrates how powerful pretax dollars can be.

Scenari0 #2

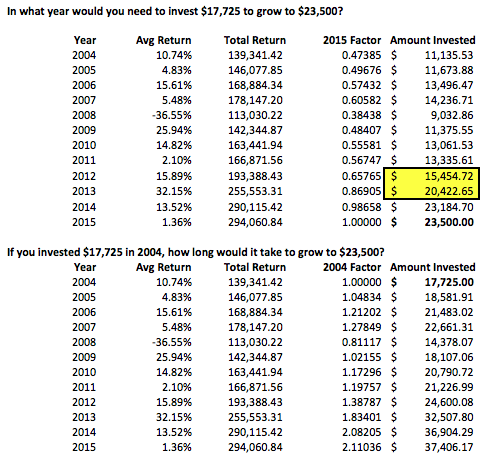

From a matter of perspective please consider the following scenario: An investor invests $17,725 into our Low Cost Index ETF Strategy, using the S&P 500 as the index. How long would it take for the investor to earn that money in the market. An interesting way to consider this is just to use the historical total return index for the S&P 500 to see how long into the past an investor would have to invest the $17,725 in order to earn $5,775. This saves us the inherent hazard of making assumptions that may or may NOT accurately capture the future. This math is easy using the data from this site.

From the charts above, you can see that an investor would have need to invest $17,725 at some point during 2012 to produce the $5,775-plus return. This short time from is somewhat biased by the stellar returns of the 2013 market. It would still have taken around 2.5 years in order to earn the necessary return.

Another interesting way to look at the numbers above, is to consider what would happen if an investor invested $17,725 on December 31, 2004. How long would it take for the investor to get to an account value of $23,500? According to the chart above, it would take until some point during 2012 to produce the necessary return. The amount was almost reached in 2007 just prior to 2008 crash. But the short term volatility of that time erased 3+ years of returns and would delay the account value exceeding $23,500 until during 2012 again. It’s funny that 2012 seems to be the answer to both questions but that is just a irrelevant coincidence.

What matters is the power of using pretax dollars to invest. Practically speaking, the $23,500 pretax contribution would be deducted on a monthly basis. The tax benefits may not be felt until you recognize the reduction in your total taxes due in the following year. However, your taxes due should fall by $5,775 and you should see that reflected in your tax return. A 32.6% return over a one-year period based on the impact to your taxable income. As you can see in the charts above, only 2013 come close to providing a nearly 33% return. Plus this initial 32.6% return continues year after year with each additional retirement contribution.